Cap-and-Invest Program compliance

Under Washington’s Cap-and-Invest Program, our state’s largest emitters must acquire enough allowances equal their covered emissions every four years. Covered emissions are a subset of reported emissions; there may be a difference between these values.

For questions about the difference between reported and covered emissions, please contact GHGReporting@ecy.wa.gov or visit the Cap-and-Invest emissions reporting webpage.

Those covered by the program, as well as those that opt into the program voluntarily, can choose their most cost-effective strategy for compliance, including:

- Purchasing allowances at auction

- Purchasing from other entities

- Obtaining allowances through no-cost allocation

- Earning or purchasing offset credits (limits apply)

- Reducing greenhouse gas emissions

- A combination of the above

To maintain compliance with the program, an entity must first register in the Compliance Instrument Tracking System Service (CITSS). After obtaining compliance instruments (allowances or offset credits) through the methods described above, an entity must then move a sufficient number of instruments into their compliance account to cover their compliance obligation. This transfer must occur prior to each compliance deadline.

See the CITSS compliance instrument transfer guide and the CITSS Compliance Management Guide for more information.

Buying and Selling Allowances

Allowances can be bought directly from a company, individual, or group who holds them, or through an intermediary (e.g., a broker). The Washington Cap-and-Invest Program Broker List contains information about groups known to work in the Washington Cap-and-Invest Program. Ecology’s mention of trade names or commercial entities does not constitute endorsement or recommendation for use. Ecology recommends interested parties to conduct a thorough due diligence before engaging in any transaction.

Please contact RegistrarCCA@ecy.wa.gov if you are a broker or exchange and would like to be added to the list.

When are compliance deadlines?

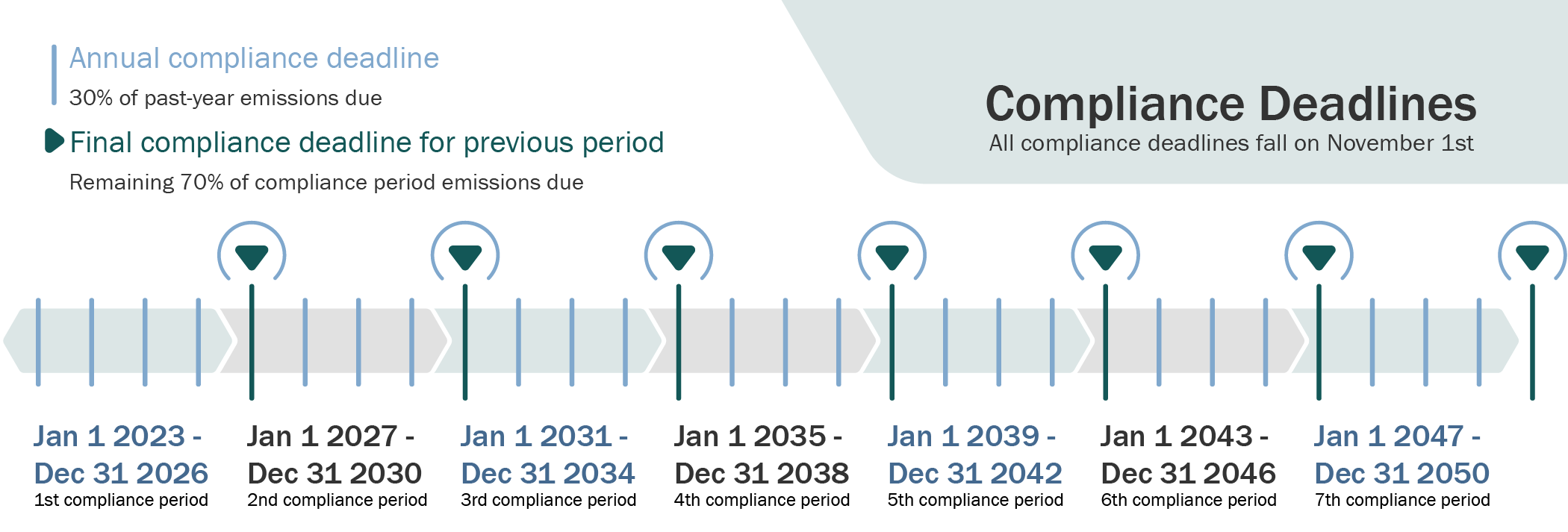

Compliance deadlines occur on November 1, at 5 p.m. PT, each year and require entities to submit compliance instruments equal to 30% of their covered emissions from the prior year.

The remaining 70% of covered emissions are due at the end of the four-year compliance period. Compliance periods are aggregate, meaning that the compliance instruments turned in each year count toward a entity's total obligation. The next compliance period deadline, covering emissions from years 2023-2026, is Nov. 1, 2027.

What are 'opt-in' entities?

Entities whose greenhouse gas emissions do not meet the Cap-and-Invest Program’s coverage thresholds can request to have compliance obligations for their covered emissions as “opt-in entities” by submitting a copy of the opt-in entity request form to RegistrarCCA@ecy.wa.gov.

Using the form, opt-in entities must attest they will report emissions to Ecology and that they are covered under Chapter 70A.65 RCW and subject to Chapter 173-446 WAC. Once approved, opt-in entities are subject to all of the same requirements in Chapters 173-441 WAC and Chapter 173-446 WAC as covered entities.

Opt-in entities must comply with Cap-and-Invest starting the year after they request to register. For example, an opt-in entity who requested to register in 2024 would have a compliance obligation to meet starting with the annual compliance event on Nov. 1, 2025, which covers 2024 emissions.

Opt-in entities must comply with Cap-and-Invest for the duration of the compliance period in which they first had compliance obligations. If an opt-in entity wishes to opt out for the next compliance period, they must do so by July 1 of the last year of the compliance period in which they are already an opt-in entity. For example, to avoid being an opt-in entity for the duration of the second compliance period (2027-2030), the entity would need to opt out of the program by July 1, 2026.

Where can I find my compliance obligation?

CITSS tracks both an entity’s compliance obligation and the amount of compliance instruments available in their accounts.

Each October, we update each entities’ compliance obligation information in CITSS after their emissions are verified by a third-party verifier. Ecology also notifies account representatives directly when this information is available.

Which compliance instruments can be used for the Saturday, Nov. 1, 2025, compliance deadline?

On Saturday, Nov. 1, 2025, entities are required to turn in compliance instruments equal to 30% of their 2024 covered emissions. Eligible compliance instruments include:

- Allowances with a vintage year of 2024 or earlier

- Allowances without a vintage, such as those purchased at an Allowance Price Containment Reserve (APCR) Auction

- Offset credits can be used to cover a small portion (up to 8%) of an entity’s compliance obligation. Of that, a maximum of 5% can come from projects not on federally recognized Tribal Lands.

- Allowances allocated by Ecology to entities for the purpose of reconciling actual production data compared to baseline production data, also known as “true-up”

Compliance instruments must be in an entity’s CITSS compliance account prior to the annual deadline in order to be used. For detailed guidance and information on how to manage compliance obligations in CITSS, please see the Preparing for the 2024 Annual Compliance Obligation guidance document.

Compliance reports

Each November, we publish a snapshot report detailing company-level emissions and compliance for that year's compliance event. Ecology will publish summary reports for the 2024 Annual Compliance Obligation following the 2024 compliance event.

In the future, when new reports are published, we’ll archive previous compliance reports here.

Contact information

Cap-and-Invest Auctions Team

RegistrarCCA@ecy.wa.gov

360-407-6296