Washington's Cap-and-Invest Program

Businesses covered by the program must obtain allowances equal to their emissions and submit them to Ecology according to a staggered four-year compliance schedule. The first compliance deadline was Nov. 1, 2024, at which time businesses needed to have allowances to cover 30% of their 2023 emissions.

How Cap-and-Invest will help Washington go carbon neutral

In 2021, the Washington Legislature adopted a historic package of legislative and budget proposals to combat climate change and prepare the state for the future low-carbon economy. The Legislature provided Ecology with the authority and funding to develop rules and requirements to implement three major climate bills: Climate Commitment Act, the Clean Fuel Standard, and an expanded hydrofluorocarbon transition.

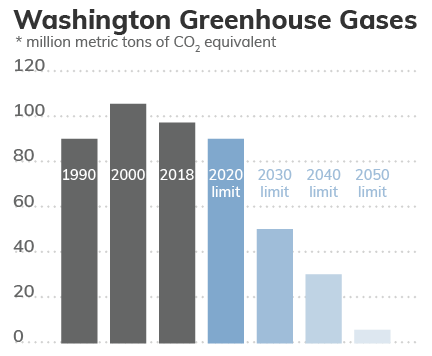

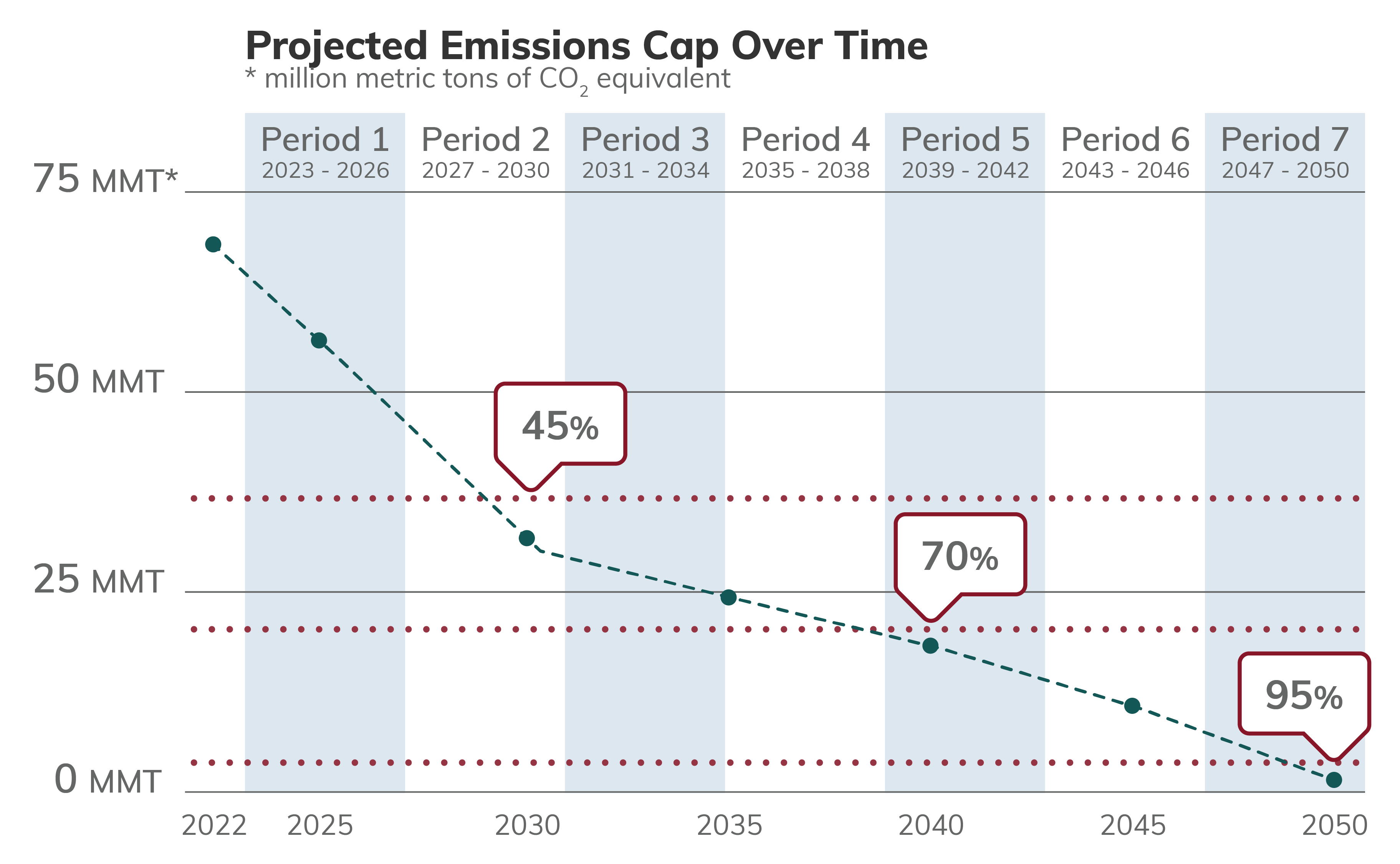

Together with existing policies advancing clean energy and zero-emission vehicles, these new laws put Washington on a path toward achieving the greenhouse gas limits set in state law: 45% below 1990 levels by 2030, 70% below 1990 levels by 2040, and 95% below 1990 levels and net-zero carbon emissions by 2050.

How Cap-and-Invest works

The Cap-and-Invest program sets a limit, or cap, on overall carbon emissions in the state and requires businesses to obtain allowances equal to their covered greenhouse gas emissions. These allowances can be obtained through quarterly auctions hosted by Ecology, or bought and sold on a secondary market (just like stocks and bonds).

The cap will be reduced over time to ensure Washington achieves its 2030, 2040, and 2050 emissions-reduction commitments, which means we'll issue fewer emissions allowances each year.

Cap-and-Invest 101

The Cap-and-Invest Program is pretty complex and has a lot of moving parts. Below, we've answered some of the most common questions we receive about how this program works. If you don't see the answer you need, you can always reach out to us directly using the contact information at the bottom of the page.

You can also check out our CCA 101 publication, which helps explain the program.

The basics

Auctions

Learn more

Related links

Contact information

- General Climate Commitment Act questions: CCAQuestions@ecy.wa.gov

- Emissions reporting and verification: GHGReporting@ecy.wa.gov

- Auctions, CITSS, or auction platform registration, or emails with market-sensitive information: RegistrarCCA@ecy.wa.gov (secure) or 360-407-6296

- Offset projects and credits: CCAOffsets@ecy.wa.gov

Stay Informed

Sign up for CCA email alerts